Key Performance Data Tables

The Kroger team recognizes our unique role in the future of food. We are helping build a more resilient and equitable food system that preserves access and affordability—today and in the future—by advancing more responsible and sustainable production methods for the food and consumer goods on which we all depend.

People: Serving Our Associates, Customers and Communities

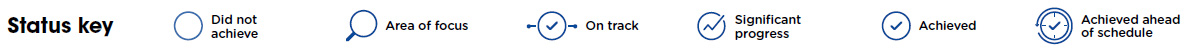

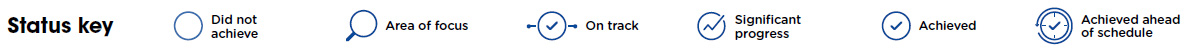

| Goals & Metrics | 2021 | 2022 | 2023 | Baseline | Target Year | Status |

|---|---|---|---|---|---|---|

| Associate Wages & Benefits | ||||||

| Cumulative investment in our associates' compensation and benefits | $1.2B | $1.9B | $2.4B | 2018 | — |  |

| Increase average retail hourly wages and benefits over time | Over $17/hour; over $22/hour including benefits |

Over $18/hour; over $23.50/hour including benefits |

Over $19/hour; nearly $25/hour including benefits |

— | — |  |

| Food Access & Affordability | ||||||

| Increase annual sales of affordable, quality Our Brands portfolio of products | $28B | $30B | $31B | — | — |  |

| Introduce new affordable Our Brands products | 660 | 680 | 700+ | — | — |  |

| Annual total meals donated to our communities—food and charitable donations | 546M | 599M | 455M | — | — |  |

| Cumulative total meals donated since 2017—food and donations | 2.3B | 2.9B | 3.4B | 2017 | 2025 |  |

| Donate surplus fresh food from stores and facilities to our communities through Kroger's Zero Hunger | Zero Waste Food Rescue program | 94M pounds | 106M pounds | 114M pounds | — | — |  |

| 100% of retail stores actively donating surplus fresh food | 93% | 100% | 100% | 2017 | 2025 |  |

| Company-wide donations of fresh Produce, Deli and Dairy items make up 45%+ of total donations to improve nutrition security | 42% | 45% | 45% | 2017 | 2025 |  |

| Charitable Giving | ||||||

| Total annual charitable giving to our communities | $343M | $336M | $329M | — | — |  |

| Share of total charitable giving donated to national and local organizations helping end hunger | $210M | $253M | $256M | — | — |  |

| Supplier Diversity & Inclusion: Certified diverse-owned suppliers have the opportunity to participate and compete for contracts | ||||||

| Annual spend with certified diverse-owned businesses1 | $3.1B | $3.5B | $3.6B | — | — |  |

M = million B = billion

- Reflects restated results after comprehensive review of supplier certification status

Planet: Protecting Natural Resources for a Brighter Future

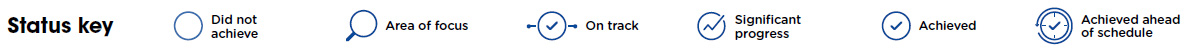

| Goals & Metrics | 2021 | 2022 | 2023 | Baseline | Target Year | Status |

|---|---|---|---|---|---|---|

| Climate Impact1 | ||||||

| Achieve a 30% cumulative reduction in GHG emissions (percentage reduction from baseline; annual total Scope 1 and 2 GHG emissions) | 9.1% 5,251,448 MTCO2e |

15.2% 4,894,705 MTCO2e |

12.0% 5,081,613 MTCO2e |

2018 | 2030 |  |

| Operational Waste | ||||||

| Achieve 90%+ waste diversion from landfills company-wide2 | 79% | 82% | 82% | 2016 | 2025 |  |

| Phase out single-use plastic grocery shopping bags | Developing roadmap | Using pilots to refine roadmap | Using pilots to refine roadmap; 700+ stores phased out plastic bags due to legislation | 2018 | 2025 |  |

| Food Waste | ||||||

| Reduce total food waste generated in retail stores by 50% cumulatively from 2017 baseline (cumulative reduction; annual tons generated) | 19.7% 269,382 tons |

26.2% 245,289 tons |

20.0% 265,773 tons |

2017 | 2025 |  |

| Achieve 95% diversion of remaining retail food waste from landfill | 48.8% | 45.9% | 51.7% | 2017 | 2025 |  |

| Strive for 95% or more of retail stores participating in food waste recycling programs | 92% | 92% | 95% | 2017 | 2025 |  |

| Our Brands Product Packaging Sustainability3 | ||||||

| Seek to achieve 100% recyclable, compostable and/or reusable packaging | 40% | 37% | 52% | 2020 | 2030 |  |

| Increase recycled content in packaging so Our Brands portfolio collectively contains at least 10% recycled content | 14% | 18% | 10% | 2020 | 2030 |  |

| Biodiversity & Resource Conservation | ||||||

| Pollinators | ||||||

| Set new Goal to Protect Pollinators & Biodiversity to reduce pesticide use in fresh produce supply chains | — | — | — | — | — | NEW |

- Consistent with prior years, partial Scope 3 emissions for 2023 are reported in the Climate Impact and Supplemental Data sections of the report. We also include a full Scope 3 inventory for 2021. We will report full Scope 3 inventories in the future

- Progress reflects calendar year data with the exception of construction waste, which reflects fiscal year

- We calculated our first packaging baseline for Our Brands products in 2022 for the 2021 performance year. The current dataset is focused on Our Brands food; health and beauty; cleaning; and deli and bakery products. We continue to expand on and improve our packaging dataset, particularly as we prepare for legislated reporting in the future. Narrative about additional stated packaging sustainability goals is included in the Waste & Circularity section of the report

| Goals & Metrics | 2021 | 2022 | 2023 | Baseline | Target Year | Status |

|---|---|---|---|---|---|---|

| Seafood Sustainability1 | ||||||

| Source 95% or more of wild-caught seafood from fisheries that are Marine Stewardship Council (MSC) certified, in MSC full assessment, in comprehensive fishery improvement projects or certified by other Global Sustainable Seafood Initiative-recognized programs | 94% | 95% | 96% | 2020 | Ongoing |  |

| Preferentially source wild-caught seafood volume from fisheries that are MSC certified | 77% | 76% | 80% | 2020 | Ongoing |  |

| Source 95% or more of farm-raised seafood from farms that are Best Aquaculture Practices 2-Star or greater certified, Aquaculture Stewardship Council certified or GLOBALG.A.P. certified | 98% | 99% | 98% | 2020 | Ongoing |  |

| Source 100% of shelf-stable tuna from companies aligned with the International Seafood Sustainability Foundation2 | 97% | 98% | 99% | 2020 | Ongoing |  |

| Source 20% of Our Brands shelf-stable tuna from fisheries that are MSC certified | 2.7% | 17.7% | 7.3% | 2020 | 2025 |  |

| No-Deforestation Commitments3 | ||||||

| Source palm oil, palm kernel oil and palm oil derivatives in Our Brands products from sources certified to the Roundtable on Sustainable Palm Oil supply chain standard (percentage of ingredient volume that is from certified sources) | 88% | 96% | 98% | N/A | Ongoing |  |

| Used post-consumer recycled content fiber and/or virgin fiber certified to FSC, SFI or PEFC standard | ||||||

| Kroger plants (percentage of packaging procured, by weight, from certified sources and/or including recycled content) | 95%4 | 95% | 99% | N/A | 2025 |  |

| All Our Brands household paper products and paper product packaging (percentage of material, by weight, from certified sources and/or including recycled content) | Household: 92%4 Packaging: 33% |

Household: 93% Packaging: 45% |

Household: 94% Packaging: 45% |

N/A | 2030 |  |

| Use deforestation-free soy-based ingredients in Our Brands products | ||||||

| Kroger plants (percentage, by weight, from no-/low-risk countries) | 100% | 99% | 99% | N/A | 2025 |  |

| All third-party produced Our Brands products (percentage, by weight, from no-/low-risk countries) | 90% | Assessed periodically | 93%5 | N/A | 2030 |  |

| Use deforestation-free beef-based ingredients in Our Brands products and fresh beef | ||||||

| Beef in fresh meat department and Kroger plants (percentage, by weight, harvested in no-/low-risk countries; born, raised and harvested in no-/low-risk countries) | 99% (87%) | 99% (78%) | 97% (94%)6 | N/A | 2025 |  |

| All third-party produced Our Brands products (percentage, by weight, from no-/low-risk countries) | 26% | Assessed periodically | 50%7 | N/A | 2030 |  |

- Progress reflects calendar year data. The timeline for these goals ended in 2023. We are revising the goals to make them ongoing so that we continue to strive for and maintain 95% or greater alignment with Kroger's Seafood Sustainability Policy for our Seafood department

- This is an enduring commitment that we continue to maintain. Percentages are measured by volume. In 2023, the remaining tuna not aligned with the International Seafood Sustainability Foundation alignment requirement was a new product that we expect to align with this requirement in the future

- No-deforestation goal progress reflects calendar year data with the exception of our packaging baseline calculation, which reflects fiscal year data

- We restated 2021 values to reflect a clarification to data inputs

- In 2023, 93% of soy-based ingredients in Kroger third-party manufactured Our Brands products was from low-or no-deforestation risk regions and 2% was from potentially high-risk regions. Suppliers of products with the remaining 5% of ingredients could not provide visibility to the country of origin

- 97% of beef-based ingredients in our fresh meat case and manufacturing plants, by volume, was harvested in regions with low- or no-deforestation risk. In addition, 94% was from cattle born, raised and harvested in low- or no-deforestation risk regions

- In 2023, 50% of beef-based ingredients in Kroger third-party manufactured Our Brands products was from low- or no-deforestation risk regions, and 49% was from potentially high-risk regions. Suppliers of products with the remaining 1% of ingredients could not provide visibility to the country of origin

Governance

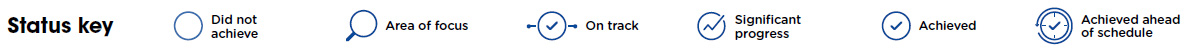

| Goals & Metrics | 2021 | 2022 | 2023 | Baseline | Target Year | Status |

|---|---|---|---|---|---|---|

| Responsible Sourcing: Animal Welfare | ||||||

| Laying Hen Housing | ||||||

| Revenue: Increase sales of shell eggs from laying hens in cage-free or better housing systems as a percentage of total egg revenue1 | 45.9% | 32.3%2 | 51.9% | — | — |  |

| Volume: Increase shell eggs sourced from laying hens in cage-free housing systems or better (units: dozens) to 70%1 | 27% | 33.6% | 33.2% | — | 2030 |  |

| Sow Housing3 | ||||||

| Volume: By 2025, Kroger aims to source 100% of fresh pork from sows in group housing systems, based on availability | — | — | 62.2% | — | 2025 |  |

| Broiler Chicken Welfare4 | ||||||

| Achieve the following welfare enhancements in at least 50% of our supply for Simple Truth Organic® and Simple Truth Natural® fresh chicken: | ||||||

| Maximum stocking density of 6.0 pounds/sq. foot | 17.5% | 17.9% | 37.8% | — | 2024 |  |

| Prohibit broiler cages | 100% | 100% | 100% | — | 2024 |  |

| Enriched environments, including litter, lighting and enrichments | 48% | 41.9% | 39.5% | — | 2024 |  |

| Processing in a manner that avoids pre-stun handling and uses controlled atmosphere systems (CAS) | 10.4% | 10.9% | 14.5% | — | 2024 |  |

- Restated progress to align shell egg units to dozens for all years

- This percentage declined in 2022 as a result of customer purchasing behaviors, supply constraints for cage-free eggs and pricing changes during recent inflationary periods

- Given the lack of industry alignment on standards and definitions for sow housing, we are unable to determine accurate year-over-year performance for 2022 and prior years

- Goal progress is impacted by industry challenges, such as the time and cost required to transition growing operations to larger barns and CAS systems